Investment update with John Pearce - October 2021

Our three best-performing investment options over the last 12 months weren’t—for once—dominated by big US tech companies. Instead, options featuring Australian shares were our star performers, with returns of 27-30%.* What’s behind these stellar stats in the middle of a pandemic, and with fears building about inflation?

We’ve also made headlines for being part of the largest retail property transaction in Australian history, purchasing significant stakes in two prime shopping centres—Sydney’s Macquarie Centre, and the Gold Coast’s Pacific Fair. But if the internet has killed shopping centres, why the cash splash?

Key points in Chief Investment Officer John Pearce’s latest video:

- Welcome to new members who have joined us since we opened to the public in July!

- Global economies are rebounding with a vengeance. Typically, this would trigger fears of inflation and market falls, leading central banks to tighten interest rates. But central banks aren’t responding uniformly—New Zealand has increased rates, Australia is likely to hold rates until 2024, and the world’s most important central bank, the Federal Reserve, is sending mixed messages.

- Emergency monetary policy settings are coming to an end, meaning we may see a lot of volatility in financial assets, share markets, and bond markets. This doesn’t mean share markets won’t rise—they’re currently at all-time highs—it just means that the swings could be larger.

- Over the last 12 months, the underlying strength of the Australian economy has led to the strong performance of our investment options that feature Australian shares. For example, the Commonwealth Bank—Australia’s largest company—was up nearly 20%.

- As the largest shareholder in Sydney Airport with a stake of 15%, we support latest takeover bid at $8.75 per share—a significant premium on the trading price prior to the bid. Deal or no deal, we’ll be holding on to our 15% share.

- In our view, the death of shopping centres has been greatly exaggerated. In the first six months of 2021, Scentre Group (Westfield) has signed over 1,500 new leases and added 139 new brands to their portfolios. It’s our firm belief that shopping centres in the right location, with the right retail mix, won’t just survive—they’ll thrive.

- We invite you to register for Towards net zero: the end of the beginning—a live webcast on 12 November at 2.00pm (Melbourne time) where we’ll discuss the progress we’re making on our climate commitments. Broadcaster and journalist Ali Moore will facilitate a conversation between John Pearce and two climate specialists—Professor Mark Howden from the Australian National University’s Institute for Climate, Energy & Disaster Solutions, and Wei Sue from ClimateWorks Australia. Register now.

-

Read the transcript

John Pearce: Hello, I’m John Pearce, the Chief Investment Officer of UniSuper. Welcome to this investment update. And a particularly warm welcome to our new members who have joined since we opened to the general public.

Today I’ll cover a few things. Firstly, I’d like to talk about where we are in the economic or financial cycle. I’d like to allude to what these conditions are doing for the performance of some of our star-performing investment options. And I’ll round it off by highlighting some of the big exciting investments that UniSuper has been involved with, that have recently made the headlines in the financial press. But firstly, let’s talk about the big picture.

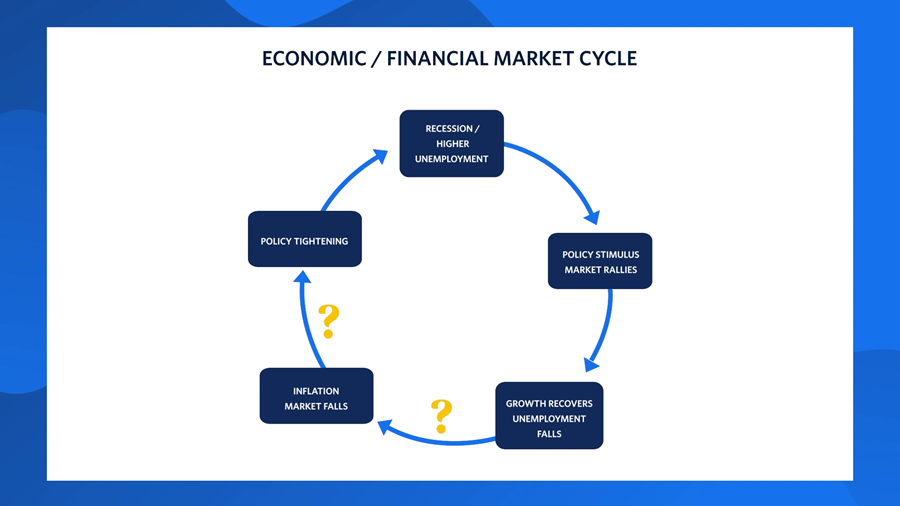

In the last couple of updates, I referred to the economic or financial cycle, and depicted it as you see on your screen. In June of this year, I made the point that it was very clear that global economies are rebounding, and they’re rebounding with a vengeance. In the typical cycle, when you see that, you’ll find that inflation fears are triggered. Central banks get a little bit worried, rates start tightening. And that’s typically enough for share markets to stop their upward trend.

I did, however, pose a couple of questions. Firstly, was this explosive growth indeed going to lead to inflation? Because let’s face it, we haven’t had it for a couple of decades. And indeed, were central banks going to get worried about signs of inflation, to the extent that they would tighten rates? And then indeed, would that lead to share market falls?

Chart 1: Chart showing the economic / financial cycle. Typically, recession and higher unemployment is followed by: policy stimulus and market rallies; a recovery in growth and a fall in unemployment; inflation and market falls; policy tightening. Then the cycle repeats. Two question marks signify that uncertainties exist regarding inflation and market falls, and policy tightening.

Well, we roll the clock forward. We’ve at least had a few of those questions partially answered. One thing we can say for sure, is that there are clear signs of inflation. If you look at the US, for example, we’re now getting quarterly prints in inflation, that if annualised, are reading as high as they’ve read in about four decades. If you look at gas prices in Europe, they’re up fivefold in six months. If you look at the cost of shipping, it’s up seven and eightfold versus pre-crisis levels. Used cars are up in price nearly 50% in the US. So, inflation is everywhere. The question is whether it’s transitory, or whether it’s persistent.

Do not understate the importance of this. If you look at the course of financial markets over the next 12 months, while inflation might not be everything, it’s nearly everything. So it’s really important.

There are broadly two camps. Firstly, we call them the optimistic camp. And they’re saying, look, this is just a transitionary phenomenon. It’s all about supply chain bottlenecks. Of course costs are going up, we’re in the middle of a pandemic. Try and get people to go to factories and work, try and get people to drive trucks or man ports, etc. Yes, we have got acute shortages, and this is leading to cost increases, and therefore price increases.

But this is all going to be transitory. Eventually, the large deflationary forces, particularly technology, will drive prices down and we’ll be back in that very low inflation environment that we’ve seen really, for the past couple of decades.

The other camp, let’s call them the more pessimistic ones, are saying no, you’ve got this wrong, this is far more persistent than you’re admitting. This is not just about supply bottlenecks. In fact, we’re seeing some easing of supply bottlenecks. This is also about rampant demand. And indeed, if you look at demand for goods, it’s back above pre-COVID levels. And that demand has been stoked by monetary policy, interest rates that are way too low, quantitative easing, but also spending by governments that is absolutely rampant. In terms of the supply bottlenecks, they also allude to the fact that the labour force participation rate has dropped, and it might stay lower than people think, for a long period of time. There are people leaving the workforce, with no intention of coming back.

Most problematic is that inflationary expectations are now moving higher across the board. Ultimately, this will lead to higher wage negotiations, and inflation then becomes endemic. So their solution is very clear—start hiking rates, and start taking away the punchbowl from the party.

Where do central banks fit into all this, i.e. that second question? It varies. The response is not uniform. There’s a ‘yes’ camp, a ‘no’ camp, and a ‘maybe’ camp. The yes to higher interest rates, for example, is the Reserve Bank of New Zealand. They’ve already hiked rates. The no camp is the Reserve Bank of Australia. They’re maintaining that they won’t have to raise rates until 2024.

I put the Federal Reserve, which is the most important central bank, in the maybe camp. They’re saying that interest rate hikes are a very long way off. But every time they meet, they seem to be bringing that date forward. So I put them in the maybe camp.

One thing for sure—we are definitely at the end of emergency settings in this cycle, when it comes to monetary policy. Rates are either going to stay where they are, or they’re going up. And typically, when you see these turning points in cycles, it’s usually accompanied by a lot of volatility in financial assets, share markets and bond markets. That doesn’t mean that share markets can’t still rise, it just that means that the swings are going to be larger. And indeed, share markets have risen. They’re hitting all-time highs. But this time, it’s with a bit of a difference. Let me explain why.

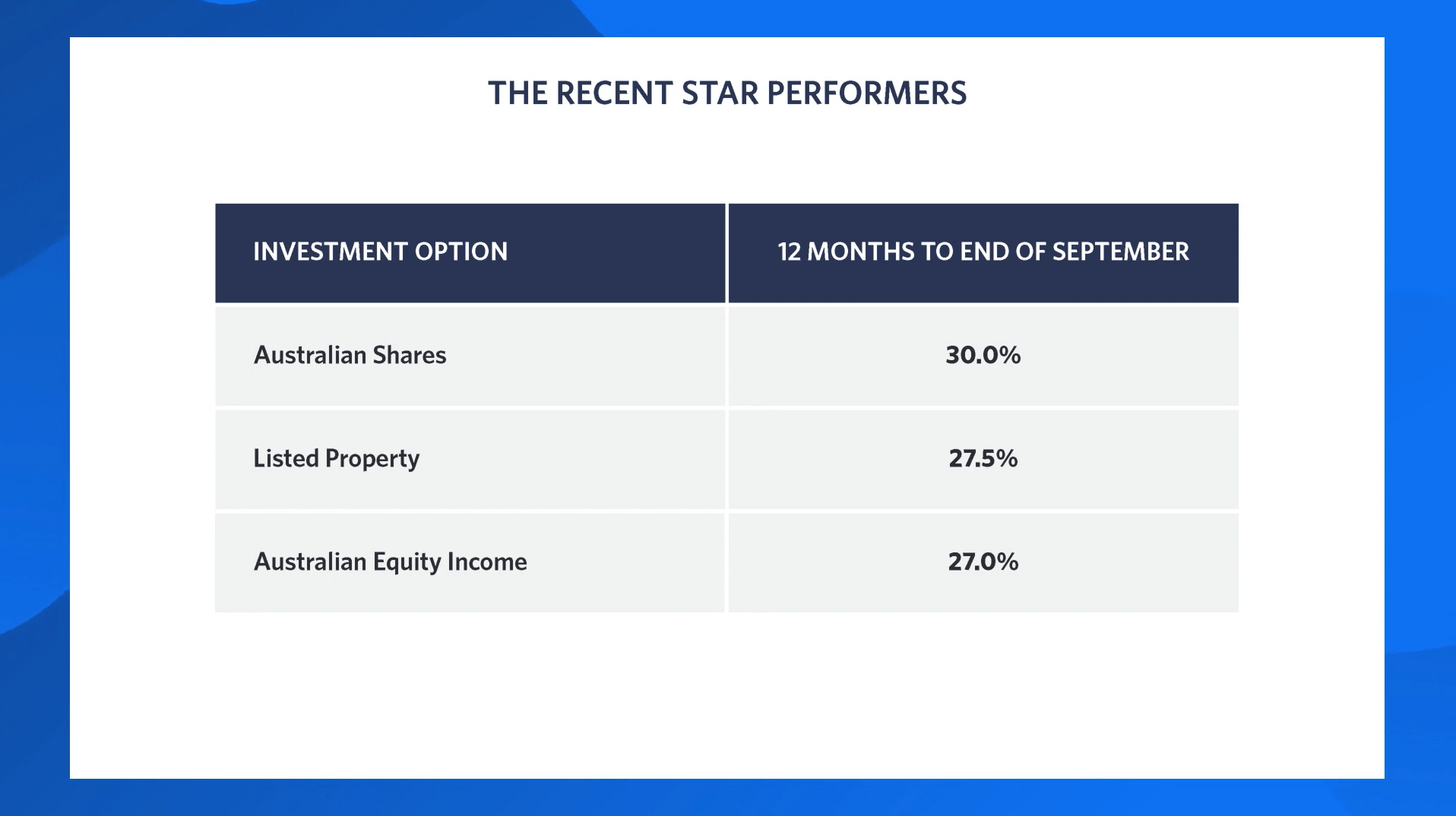

Take a look at this table. Here are the three best performing options over the last 12 months.

Chart 2: Chart showing the investment returns of UniSuper’s three top-performing investment options over the 12 months to the end of September 2021. Australian Shares: 30%. Listed Property: 27.5%. Australian Equity Income: 27%.

What we don’t see here is your typical table, where we’ve got international share options full of those great US tech companies. No, the top performing option, with 30% 12-month returns, is the humble Australian share options.

Why are these great returns at a time when we’re still in the middle of a pandemic, with all these fears about inflation? It’s because the economies are very strong, and economic growth is filtering into higher revenues. Costs to date have been pretty stable, therefore we’ve got higher profits.

To give you an example, look no further than the Commonwealth Bank, which happens to be the largest company in Australia. It constitutes about 8.6% of the index in Australia. Year on year profits of the Commonwealth Bank are up nearly 20%. Dividends, up 17%. The Commonwealth Bank’s capital position is so strong, that the company was able to announce a $6 billion buyback of its own shares.

When you consider how large a weighting the banks have in our Australian share market, you can see why our market is doing really well. But the general point I’m making is that even in rising rate environments, share markets can still rally. They can still be sustained, if indeed profits are increasing.

Finally, let’s point out some of the highlights in terms of what’s making the financial press lately that relates to UniSuper. Firstly, Sydney Airport. Many of you will be aware that Sydney Airport has received a $8.75 takeover bid. Now that follows two previous bids that were rejected by the Sydney Airport board. $8.75 represents a very significant premium to where the shares were trading prior to the bid. So the board has done very well. And it sees $8.75 as a fair price, and has accepted it.

UniSuper is the largest shareholder in Sydney Airport, with a 15% holding. The bid was made conditional on UniSuper rolling in our stock, so that we actually remain as owners in the new vehicle. We are in the middle of due diligence right now. I’m very hopeful that a deal will be done. However, the deal will still be subject to regulatory approval, so there are certainly no guarantees. It’s important to note, however, that deal or no deal, UniSuper will be holding on to its 15% share because Sydney Airport is a fantastic asset, and we are long term holders.

Moving on now to Transurban. You’ll be aware that Transurban is the owner and operator of most of the toll roads in Australia. Recently a consortium led by Transurban was successful in bidding for 50% of WestConnex that it didn’t already own. WestConnex is the toll road linking Sydney’s west to the city and the airport. By the end of this decade, it’s expected that around 40% of Sydney’s population will be living within five kilometres of WestConnex. And that should give you an indication of how critical this infrastructure will be.

UniSuper’s a large shareholder in Transurban. We were very willing to participate in the capital raising that Transurban had to undergo to fund this acquisition. And we’ve invested over half a billion dollars in this. Once again, very confident of the returns there.

Moving on now to property, and retail property in particular. We’ve invested over $700 million in developing Karrinyup Shopping Centre, which is in Perth, so our Perth members will know it very well. We’ve been opening it in stages, and whenever we’ve opened up a new stage, we’ve got rave reviews.

Recently, it was announced that UniSuper was one of the partners in one of – well, it was actually disclosed as the largest retail property transaction in Australian history. As a result of that transaction, UniSuper members are now the owners of very significant stakes in two prime shopping centres—Macquarie Centre in Sydney, and Pacific Fair on the Gold Coast in Queensland. Anyone that’s travelled to the Gold Coast would know that shopping centre really well.

I’m sure some of you are thinking, “Shopping centres, all this money going to shopping centres, hasn’t the internet and online shopping killed shopping centres?” If that’s the case, someone’s forgotten to tell these people here that are lining up outside the new Sephora store in Karrinyup Shopping Centre.

Chart 3: Image showing a crowd of people lining up outside the new Sephora store at Karrinyup Shopping Centre in Perth. The store had over 6,000 visits in the first four days of opening.

It’s our firm belief that if you have a shopping centre in the right location, with the right retail mix, not only will you survive, you’ll absolutely thrive. Another proof point—Scentre Group, which is Westfield, in the first six months of 2021 signed up over 1,500 new leases and introduced 139 new brands to their portfolio. And this is in the middle of a pandemic. So it’s fair to say that reports of the death of shopping centres have been greatly exaggerated.

We’ve discussed airports, toll roads, shopping centres. These are examples of the high-quality assets that you’ll find throughout many of our portfolios in UniSuper. Our long-term members have enjoyed the returns that we’ve received from these assets, and I’m very confident that our new members will continue to share in the prosperity.

On a final note, I know that many of you are very interested, and indeed passionate, about climate risk and our investments. I just want to give you a heads up that on the 12th of November, we will be conducting a webinar. It will be moderated by Ali Moore and I’ll be sharing a panel with two climate specialists. So look out for the invitation.

Until then, it’s goodbye, and thank you very much for tuning in.

*Past performance isn’t an indicator of future performance.

This information is of a general nature and may include general advice—it doesn’t take into account your individual objectives, financial situation or needs. Our investment strategies won’t necessarily be appropriate for other investors. Before making any decision in relation to your UniSuper membership, you should consider your circumstances, the relevant PDS and TMD, and whether to consult a qualified financial adviser. For a copy of the PDS or TMD, call us on 1800 331 685 or visit unisuper.com.au/pds.

This information is current as at 26 October 2021 and isn’t intended to be an endorsement of any of the listed securities named above for inclusion in personal portfolios. The above material reflects our view at a point in time, having regard to factors specific to us and our overall investment objectives and strategies.